Latest News

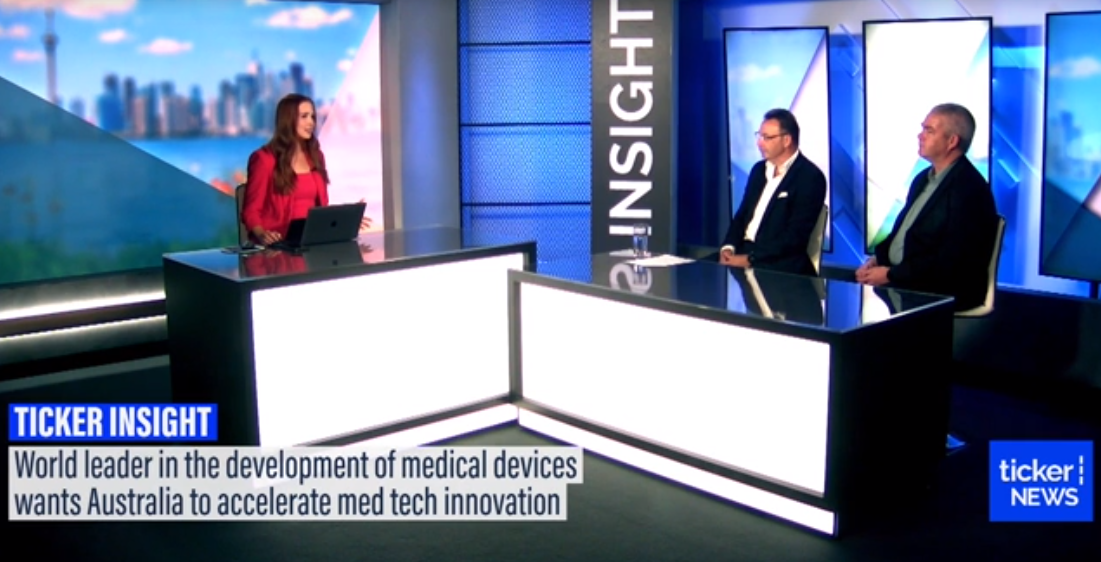

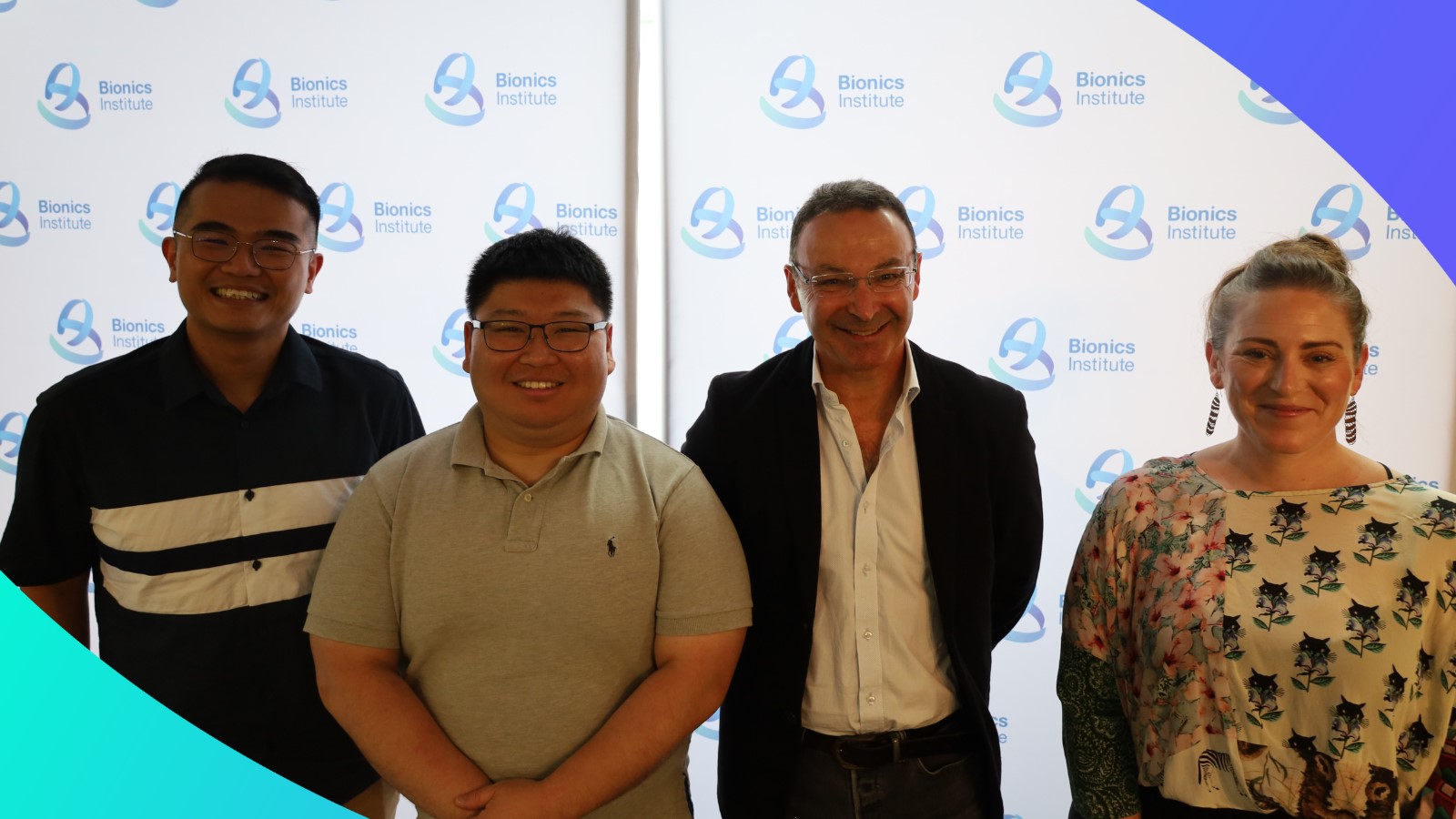

Med Tech Impact Investing: Funding Tomorrow’s Medical Breakthroughs Today

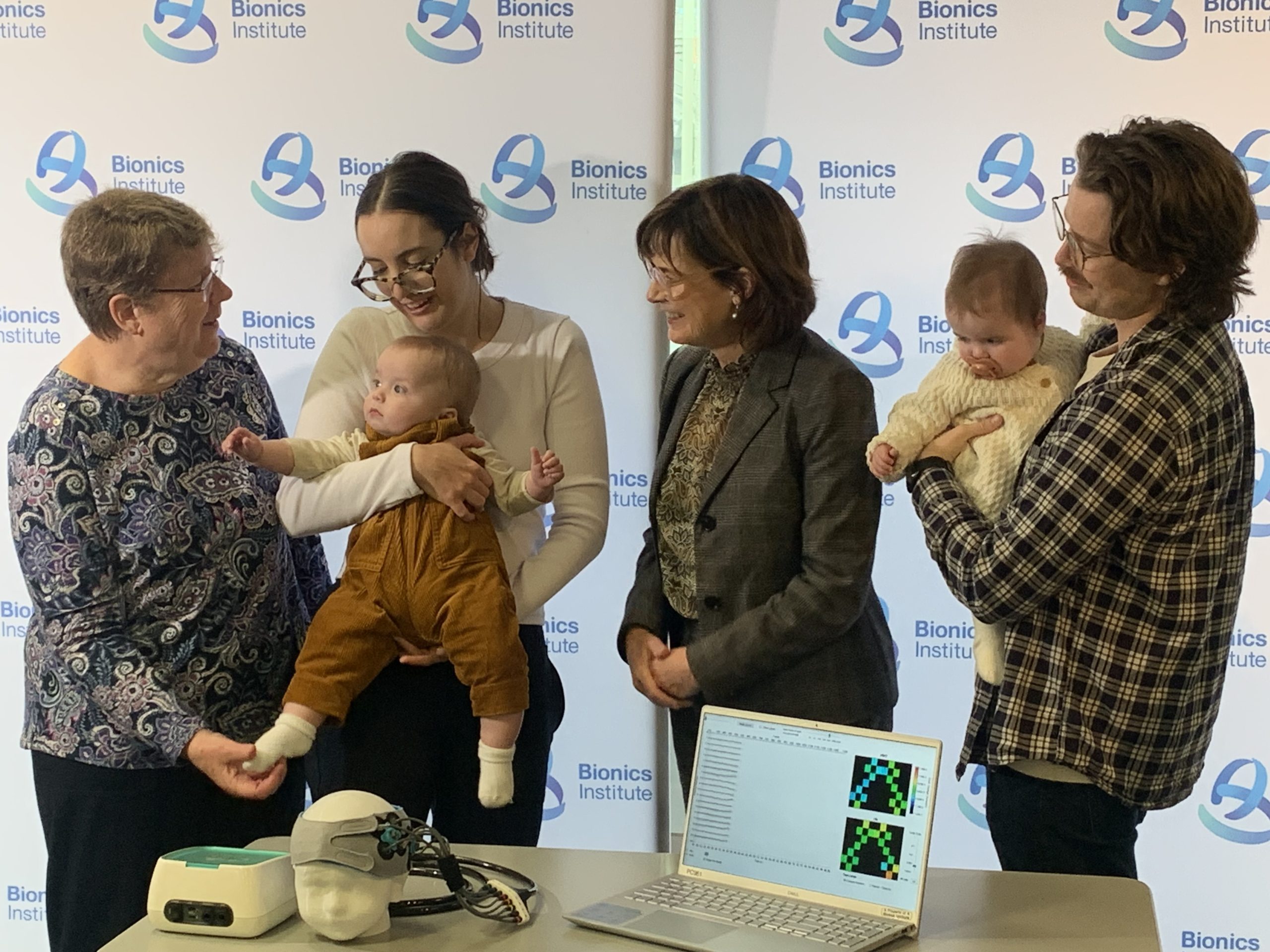

The Bionics Institute has a highly unique business model whereby our medical device research often leads to commercialisation and spin-out companies

Our business model is designed to ensure life-changing tests and treatments get into the clinic as soon as possible to benefit patients.

A 2022 ATO Ruling, unique to the Bionics Institute, allows PAFs to invest in medical device research and utililse a number of repayment options.

The ruling, 2022/54, allows PAFs and PuAFs to make a concessionary loan towards research at the Bionics Institute that can be repaid in cash or other consideration, such as equity in a spin off company.

Commercialisation and translation of our technology is of paramount importance to the Bionics Institute and we have a track record of setting up several spin-off companies including, including DBS Tech for Parkinson’s; Epiminder for epilepsy, Neo-Bionica for medical device prototyping, and NirGenie for infant hearing.

There are more spin-offs in the pipeline for conditions including: Crohn’s disease, rheumatoid arthritis, tinnitus and Alzheimer’s disease.

We feel that the Bionics Institute is a unique value proposition for impact investment, as investors have the potential to see see life changing medical technology commericalised and transform the lives of those with challenging medical conditions.

Impact investment in medtech research at the Bionics Institute via a private or public ancillary fund (PAF/PuAF) was the focus of an AICD Company Director Magazine article on 1 September 2024, titled: Bionics Institute leverages ATO ruling to appeal to new philanthropists.