Latest News

A 2022 ATO Ruling, unique to the Bionics Institute, allows PAFs to invest in medical device research and utililse a number of repayment options.

Impact investment in medtech research at the Bionics Institute via a private or public ancillary fund (PAF/PuAF) was the focus of an AICD Company Director Magazine article on 1 September 2024, titled: Bionics Institute leverages ATO ruling to appeal to new philanthropists.

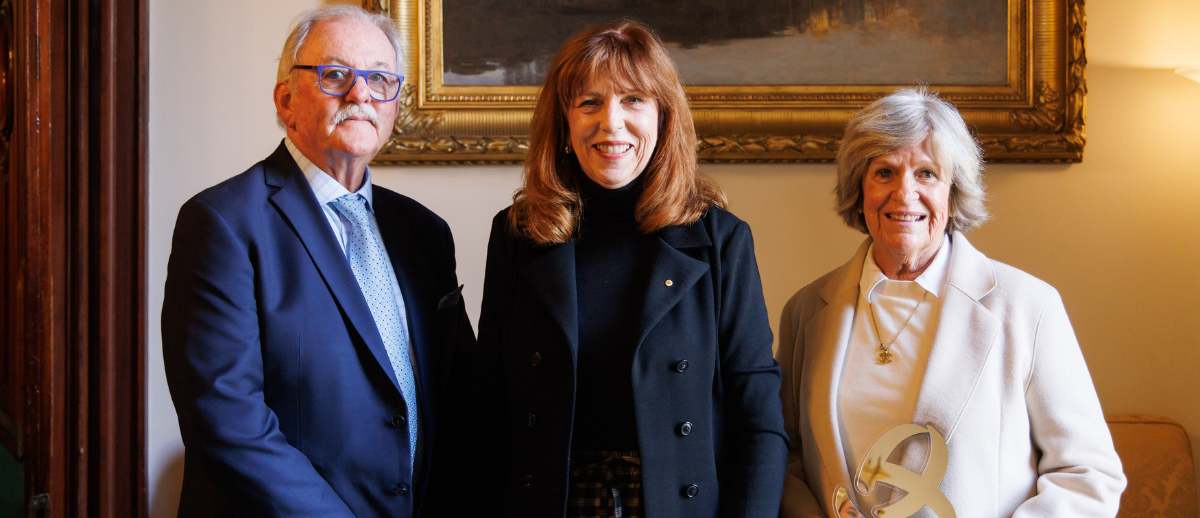

Bionics Institute CEO Robert Klupcas and Board Member, Micheal Coleman were interviewed about a 2022 ATO tax ruling, unique to the Bionics Institute.

The article describes how the ruling allows PAFs and PuAFs to make a concessionary loan towards research at the Bionics Institute that can be repaid in cash or other consideration, such as equity in a spin off company.

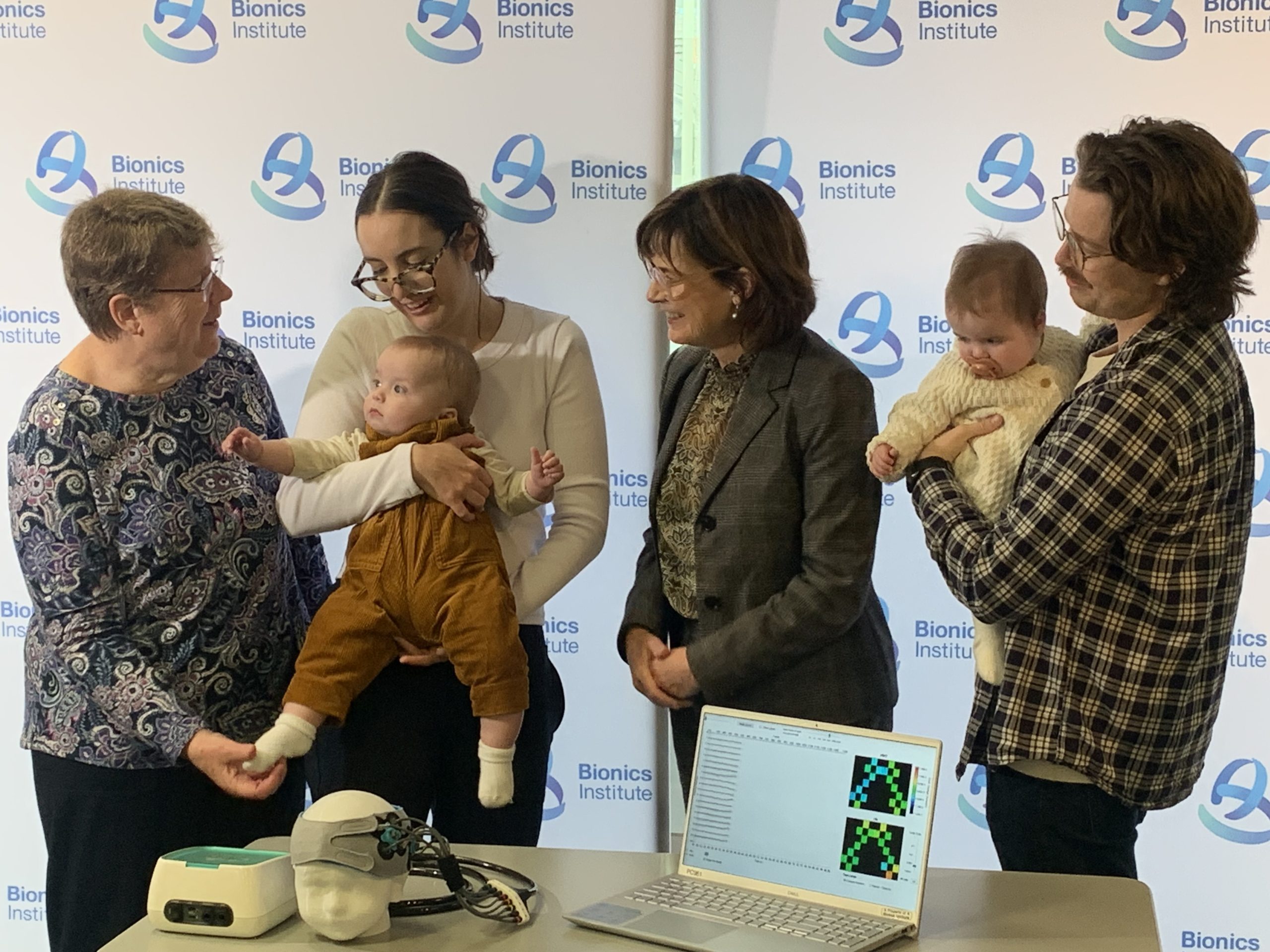

Medical device research at the Bionics Institute often leads to commercialisation to ensure life-changing tests and treatments get into the clinic as soon as possible to benefit patients.

The Bionics Institute has set up several spin-off companies in the past six years, including DBS Tech for Parkinson’s; Epiminder for epilepsy, Neo-Bionica for medical device prototyping, and NirGenie for infant hearing.

There are more spin-offs in the pipeline for conditions including: Crohn’s disease, rheumatoid arthritis, tinnitus and Alzheimer’s disease.

The ruling also allows for the foregone interest, calculated as the differential between zero percent and market rate at the time of the loan agreement, to be deemed as part of a PAF’s annual mandated distributions.

There is also the added benefit that should the loan be written off, in full or in part, that amount will be also deemed a PAF distribution.

In the article, Robert Klupacs says the Bionics Institute is well-placed to appeal to entrepreneurial donors, and that many universities and institutes are focused on discovery and knowledge generation, which can take a long time to translate into a clinical product – or event into a clinical concept.

“Where we’re different is that we’re very focused on taking these product concepts and moving them as fast as we can into the clinic to see whether they have the potential to work and be commercialisable,” says Klupacs. “Because in the end, we have a very strong philosophy that the reason we do what we do is because we want patients to benefit.”

He continues in the article: “A lot of them, because they’re entrepreneurial, love to invest directly in early-stage companies. But they know they’re very high-risk. Our model allows the charitable structure to donate to an area of work that could be translatable, which could lead to something that’s investable.”

Michael Coleman FAICDLife is featured in the article saying: “This is a very innovative structure,” he says. “I don’t know that anybody else has used it [as convertible donations]. Unless you’re anticipating an outcome — something that is commercialisable — then it’s probably just a convenient source of longer-term funding and perhaps a way of encouraging your donors to have a longer vision when they’re putting the money into your charity.”

Register your expression of interest in learning more about this unique impact investment opportunity below.