Latest News

Bionics Institute White Paper: Investing in Innovation

“Long-term investment is key to harnessing Australia’s research and development strengths and further developing our healthcare sector as a global innovation hub.”

Debby Blakey, HESTA CEO

Talking about investment in innovation is critical for the future of Australia’s economy

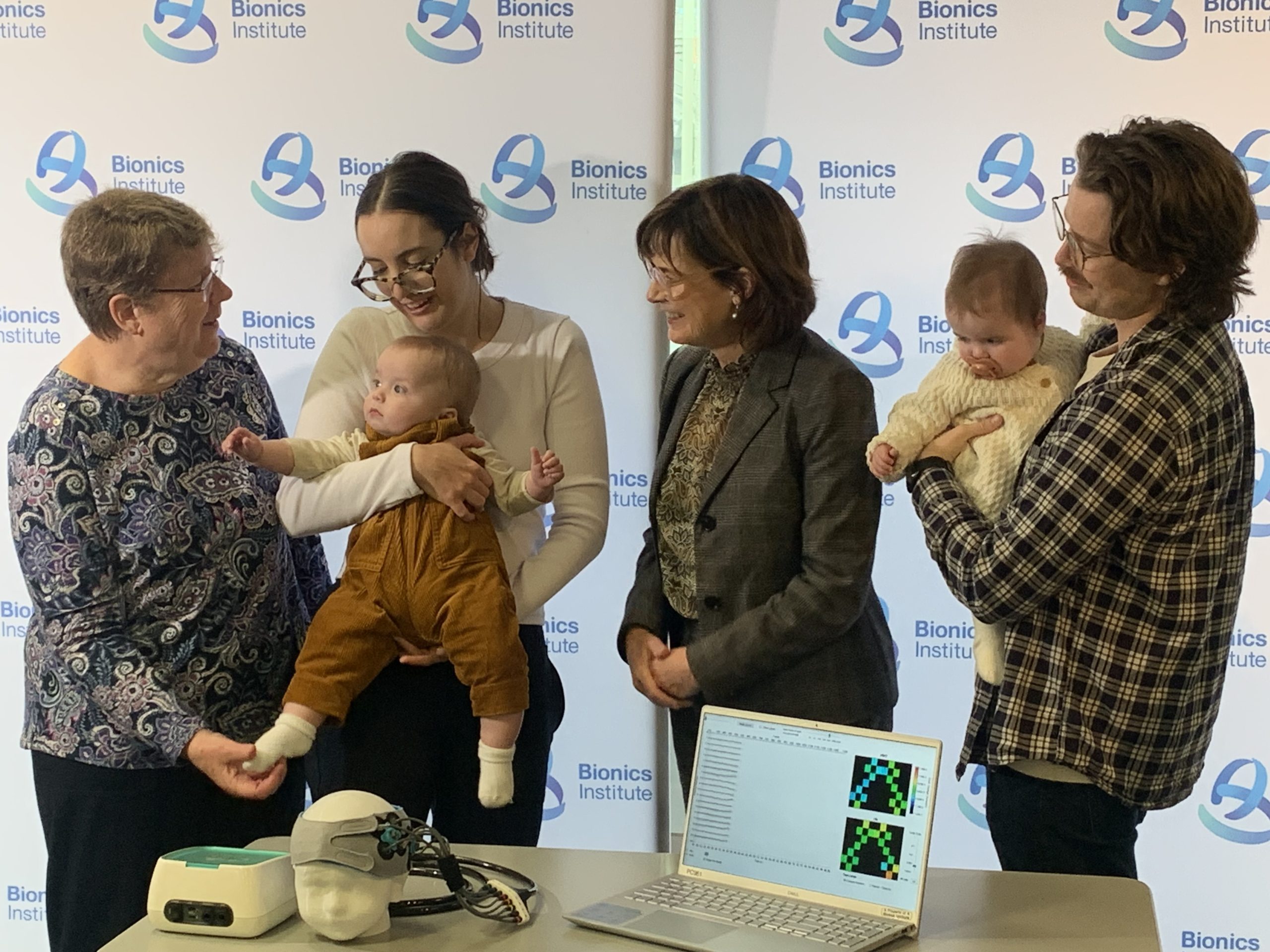

Over the past three years, the Bionics Institute has been leading the conversation about how we can build Australia through innovation.

Why did we need to talk about this? Because we believe that Australia has so much to gain if we turn to innovation as an essential pillar of our economy.

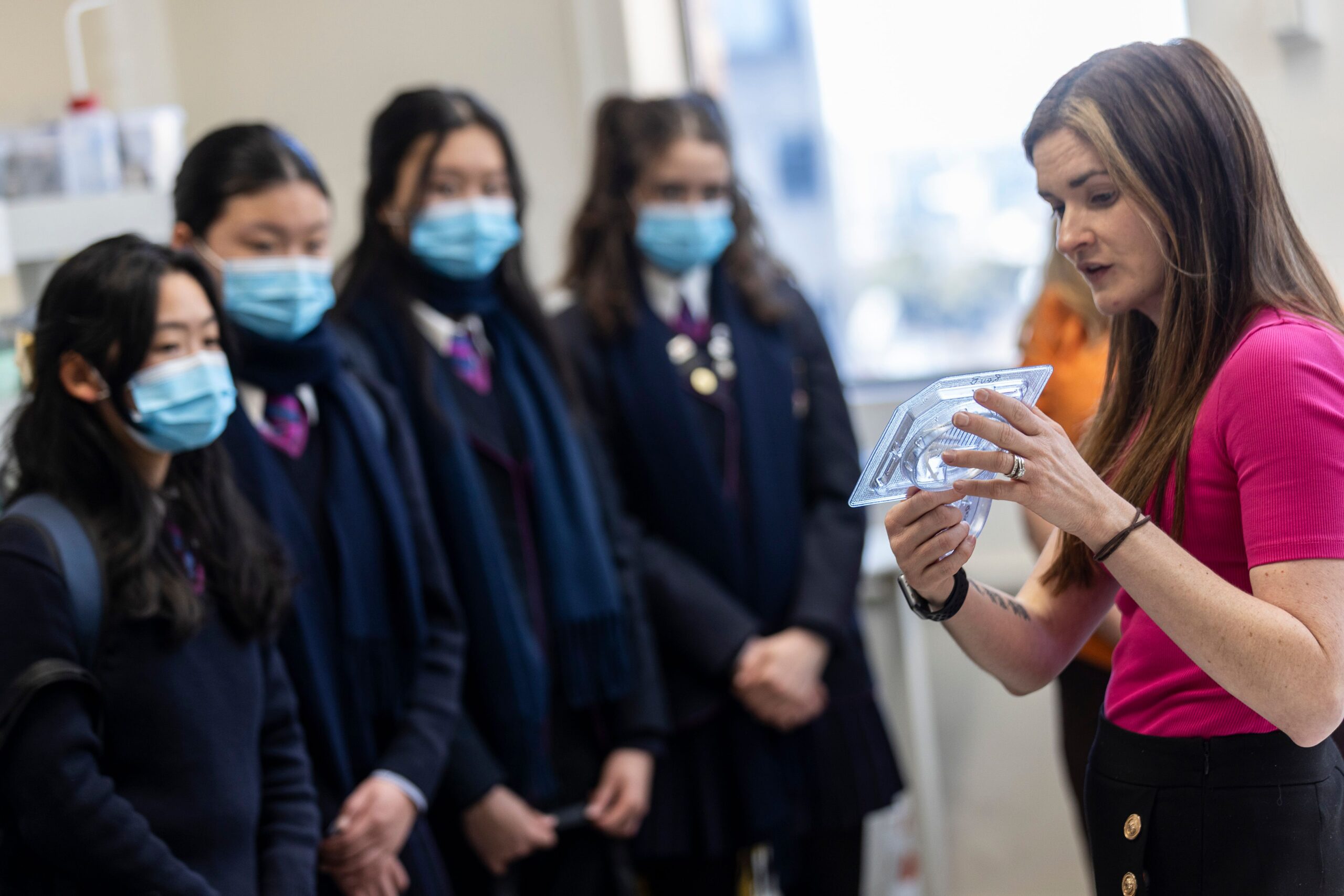

We started with the launch of our Med Tech Talks podcast, where we interview leaders, investors, researchers and entrepreneurs to explore how we can improve the translation of innovation into commercialisation to change the lives of people living with challenging medical conditions.

The podcast launch was closely followed by our first Innovation Lecture, which has become a highly anticipated annual event convening med tech thought leaders to discuss different aspects of innovation.

Our first White Paper in 2023 drew on the conversations and insights provided by our keynote speakers and podcast guests to elucidate the four ways we can supercharge innovation through: Co-location; skills development and funding; storytelling and persistence; and leveraging mentorship and partnerships.

In this White Paper we are shining a light on investment into innovation: how to source investment; how our investment landscape differs to the United States; how to optimise investment; and finally, how to survive the Valley of Death.

Four critical innovation investment conversation points

Take a look through our White Paper to learn more about:

- Funding Australian innovation to change patients’ lives

- The lure of international markets – particularly the US – and the impact this has on talent retention.

- Keeping innovation onshore so that Australia reaps the benefits

- Navigating the Valley of Death, a challenge every start up must traverse.

1. Funding Australian innovation

In the Foreword to the White Paper, Hesta CEO Debby Blakey explores how investing in Australian healthcare innovation makes good financial sense, creating long-term value for businesses and investors while strengthening the nation’s economy for future generations.

“Australia has the opportunity to create an ecosystem where innovation thrives, and researchers and businesses can access the resources they need to turn discoveries into market-ready, commercial solutions. This will help create a strong pipeline of investment opportunities with the appropriate risk-return profile investors seek to deliver strong long-term investment performance,” Blakey says.

This is backed by ANDHealth’s Bronwyn Le Grice, who says: “The only way to impact millions and millions of patients is through commercialisation.”

She sees the future of Australian innovation building with access to non-dilutive funding from schemes such as the MRFF for medical research.

Co-Founder of Kali Healthcare, A/Prof Fiona Brownfoot says: “The commercialisation landscape in Victoria has changed substantially since we started this as a research project in 2018. In that time, I’ve seen a shift in the Victorian start-up ecosystem – it seems that there is a lot more funding especially in the pre-seed stage.”

2. The Lure of the USA

The White Paper also explores why med tech entrepreneurs are drawn to the United States.

“There’s a cultural fear of failure in Australia that is somewhat destructive for the med tech environment,” says Dr Jeremy Buzzard, co-founder of Induction Bio. “In the United States the motto is: fail fast, fail often and take multiple shots at goal.”

Dr Fouras, founding CEO of 4D Medical bluntly laments the “missing zeroes” in funding in Australia, saying “it’s costing this economy, this country … tens and hundreds of billions of dollars – in my opinion $50 million solutions are not how you solve $100 billion problems”.

To attract much needed capital from US investors he relocated with his wife and five children to Los Angeles in 2016. He still describes his company as driving Australian-led change for lung health. Of his 140 employees in 2023, 18 were in the US.

He says that Australia is challenged by the small size and scope of our VC sector and the disparity of tax incentives. “I could talk about policies that really discourage people from investing in things outside of, for example, real estate in Australia but I don’t want to turn this into a discussion about negative gearing,” Dr Fouras said.

3. Keeping innovation onshore

And the White Paper goes on to highlight what we need to do to keep innovation on shore.

Dr Andreas Fouras, founding CEO and CTO of ASX listed company 4DMedical said that for Australia to achieve its potential to harness innovation and incentivise top companies to stay onshore, the processes around funding need to be innovative, too.

“We can do better and we owe it to the people coming through to make it easier – if we do that, they will reward us 10 times over.”

Stephen and Angela Tomisich, co-founders of Trajan Scientific and Medical, listed on the ASX in 2021, spent four years in the US learning to embrace risk.

Mr Tomisich believes there needs to be a shift in the Australian innovation ecosystem to support developing sovereign capability and keeping it onshore.

“Australia doesn’t have an innovation problem, but we do have a momentum problem,” he says.

“If you take a country like Finland, manufacturing is 15 per cent of their GDP. Australia’s was 15 per cent in 1990, it’s now 5 per cent. Unless we fix that fundamental profile of our economy you don’t get momentum – instead you have start-stop activities.

The stop comes either because the innovation failed or because a multinational liked what they saw and took it offshore. Off that innovation goes and then you have to start all over again.”

4. Navigating the Valley of Death

The tech sector’s infamous Valley of Death is the challenge that virtually every startup must traverse.

Sometimes the dream-ending trek between innovation and profit, is an essential part of the startup ecosystem, says Dr Emma Ball, a biotechnology expert with 25 years’ experience.

She says: “When I’m looking at an investment opportunity, I often refer back to the Six Ts, which I learnt about through investor Professor Pedram Mokrian, who works with Stanford University and the Wade Institute in Melbourne.”

The Six Ts, explained in the White Paper, are:

- Team

- Total addressable market

- Technology

- Traction

- Trends

- Terms.

“There’s a high natural attrition rate in startups and that’s not a bad thing,” says Dr Ball.

“The key is to fail early and fail fast. Learn, iterate and move on. Resources are finite. Every dollar you spend or activity you undertake represents something that isn’t being done instead. So, the quicker you can terminate a project, or an unviable activity means that you can turn your attention and investment dollars to something else more worthy. Embrace the Valley of Death!”

Acknowledgements

The Bionics Institute would like to thank the following people for their contribution to this White Paper:

Dr Emma Ball

Associate Professor Fiona Brownfoot

Dr Chrus Burns

Dr Jeremy Buzzard

Mr Robert Klupacs FTSE

Dr Andreas Fouras

Dig Howitt

Bronwyn Le Grice

Sonya Sawtell-Rickson

Stephen Tomisich

Professor Andrew Wilks

Dr Chris Smith